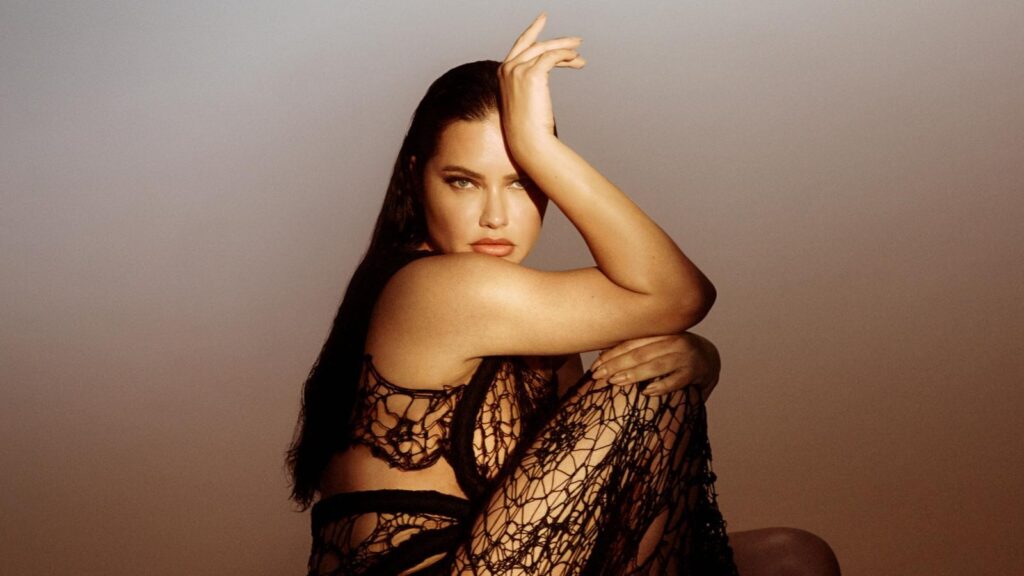

Angels have returned to the spotlight last night in New York with Victoria’s Secret’s new show, «The Tour ‘23» after a five-year hiatus. This revamped format, which marks the beginning of a new chapter, combines documentary-style footage with a fashion show that showcases an updated concept of femininity, with the contribution of female directors, musicians, artists and other talents. Four designers, Supriya Lele from London, Bubu Ogisi from Lagos, Jenny Fax from Tokyo and Melissa Valdes from Bogota, were tasked with creating individual collections. The Bts footage was documented and their interpretative designs were merged to create a single maxi fashion show, which included the latest collection by the Us lingerie brand’s style department. Some of the tops were featured in past mega shows, which included renowned international pop stars and showcased impressive sets. Adriana Lima, Naomi Campbell, Candice Swanepoel, and Gigi Hadid, along with Paloma Elsesser, Hailey Bieber, Adut Akech, Lila Moss, Sora Choi, and many others.

The Victoria’s Secret Fashion Show 2019 was cancelled following criticism of the brand’s lack of inclusivity and outdated model of femininity. After a radical rebranding effort, which addressed these issues and several scandals at the top of the company, the brand has emerged with a new, ambitious identity. In July 2021, L Brands group, the former parent company, approved the separation of the label and Bath&body works, another brand in its portfolio. Both companies then listed on the Nyse as separate entities. Since then, however, the lingerie company’s journey has been turbulent. Victoria’s Secret shares initially began at 42 dollars, equivalent to 39.1 euros at yesterday’s exchange rate, and increased to 80 dollars (74.5 euros) in the following month. Nevertheless, the stock has currently decreased below 20 dollars, experiencing a 56% decline to 18.5 dollars per share (17.2 euros) since then. While the stock rose moderately by 5% last trading week, it has decreased by over 43 percentage points on Wall street since the start of the year. Moreover, the company’s economic performance has been showing signs of slowing down.

In fiscal year 2022, Victoria’s Secret’s net sales decreased from 6.78 billion dollars in 2021 to 6.34 billion dollars (5.9 billion euros), and net income was nearly halved from 646.3 million dollars to 337.6 million dollars (314.4 million euros). Despite expanding the size range and introducing new products, which were previously deemed incompatible with the brand’s sensuality concept, the brand has not yet regained momentum. According to Barclays’ estimates, the company holds a market share of around 20% in the women’s underwear segment, far exceeding the competition who are hovering below ten. For the digital channel, the company reports a figure of 30%. Meanwhile, competitors who specialize in shaping underwear, such as Kim Kardashian’s Skims, Savage x Fenty by Rihanna, and singer Lizzo’s Yitty, have posed a challenge in recent years. However, their impact is still relatively small compared to Victoria’s Secret’s 6.3 billion dollars in sales. In addition, analysts’ predictions in the near future are generally cautious. Following a second quarter loss of 872 million dollars (812.1 million euros), management has slightly lowered its revenue and operating profit forecasts for fiscal year 2023.

It anticipates a decrease in revenues by «a low-single digit percentage» compared to the previous projection of «flat or low-single digit» revenues. Meanwhile, the operating margin forecast remains within the 5-6% range. According to Ubs analysts, «the new guidance’s lower and upper end imply 2023 earnings per share of 2.20-2.65 dollars». UBS experts maintain a sell rating on the stock and targeted a price of 16 dollars. «The center point of the revised range is just 2% lower than Victoria’s Secret’s earlier suggested values of 2.20 dollars to 2.75 dollars for Eps2023 and almost identical to the current prediction of 2.41 dollars. As a result, we anticipate that Eps estimates for the fiscal year will stay near the current levels». According to analysts from Morgan Stanley, the loss in the second quarter along with the revised guidance were not as bad as expected. The strengths of the company included sustained international success, gains in digital market share, and an increase in topline during the third quarter when compared to the second.

«We are dubious about the projected increase in profitability outlined in the implied guidance for the fourth quarter» the investment bank’s specialists noted, who still give the stock an equal-weight rating but decreased the target price from 19 dollars to 17 dollars. Morgan Stanley considers the quarterly loss to be the most recent disappointment in a string of underwhelming outcomes and questionable decisions made by the management team. «It is unclear if the underperformance reflects a broader weakness in the North American underwear market or if it is evidence of a problem specific to the company. However, we still find management’s strategic plan compelling and maintain hope that Victoria’s Secret may follow in the footsteps of Abercrombie & Fitch, which took about eight years to successfully implement» the institute concluded. Barclays analysts continue to maintain caution and reiterate their equal weight rating with a 20 dollar target. «The recent quarterly results have been disappointing due to both Victoria’s Secret and Pink brands losing market share. Moreover, there is no clear evidence that corporate initiatives are making progress», they explained. «Although August results are better, it is still unclear whether this is a general industry seasonality or a result of corporate initiatives. The guidance for the third quarter is primarily a result of marketing aimed at supporting the World Tour». (All rights reserved)

Orario di pubblicazione: 07/09/2023 11:41

Ultimo aggiornamento: 07/09/2023 12:02