[ad_1]

Article content

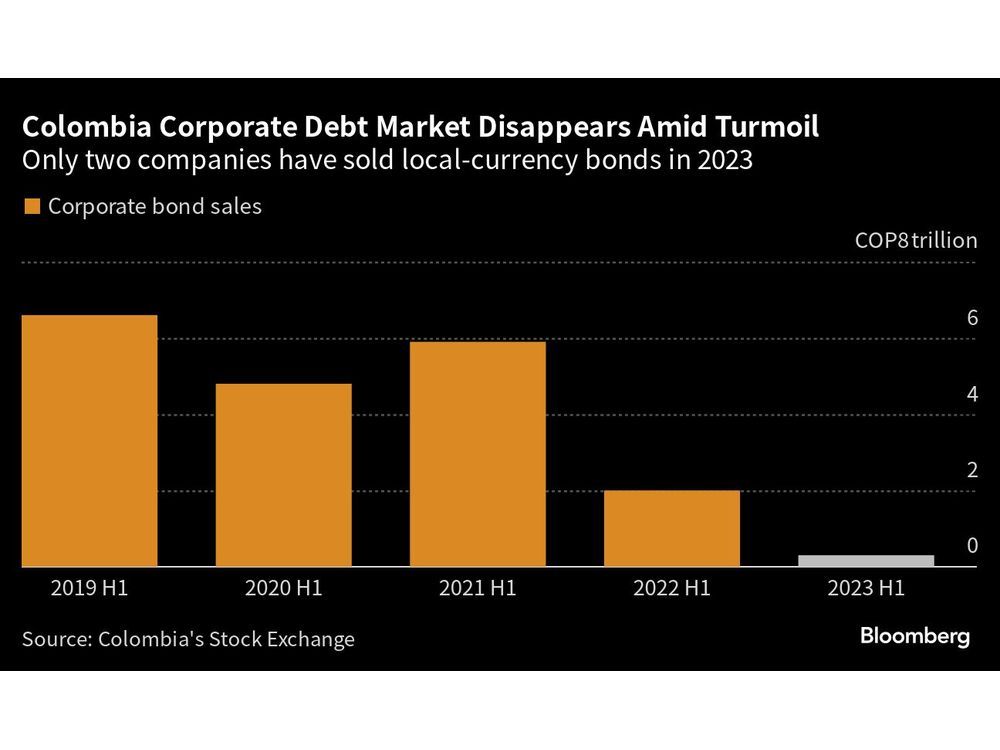

(Bloomberg) — Colombia’s local corporate bond market is all but closed.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Article content

Only two companies have sold debt this year, borrowing just 292 billion pesos ($70 million). That’s 85% less than in the same period of 2022, according to data from Colombia’s stock exchange, and a steeper plunge than the 16% dip in issuance seen across Latin America over the span.

Financial Post Top Stories

Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Financial Post Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

“We’ve never seen a drop that steep, but then again, we’d never had so many market shocks at the same time,” said Nicolás Mayorga, head of issuers, analysis and research at Colombia’s stock exchange.

The dearth of borrowing is partially explained by one of the region’s most stubborn bouts of inflation, which remains high after a year and half of interest-rate hikes. Even as consumer price increases peak, helping turn investors bullish on other assets, corporations aren’t expected to return to the market soon.

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Read more: Finance Chief Says Colombia Could Start Rate Cuts by September

Issuers — and investors — are also shying from the market amid a tumultuous period of politics a year after the nation’s first leftist president, Gustavo Petro, was elected. As his administration contends with a widening scandal, Petro continues to push controversial reforms, including limiting the role of private pension fund managers — some of the biggest buyers of corporate bonds.

“It’s not so much about companies wanting to issue or not,” said Luis Carlos Sarmiento Gutiérrez, chief executive officer of Colombia’s largest banking conglomerate, Grupo Aval. “It’s about issuing large amounts of debt at such a high cost and maybe not being able to sell it all because uncertainty overseas is still high and everyone is waiting to see how these reforms pan out.”

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Read more: Leftist Colombia Leader Delivers the Paralysis Markets Want

The decline started last year and deepened when Petro, who took office in August, announced ambitious social programs and policies meant to lift millions out of poverty. Investors feared his agenda would run up debt and hurt the currency.

The Colombian peso hit record lows and yields on local government notes, known as TES, rose above 15% in October.

One of the two companies to tap markets this year was a vehicle financing firm, Finanzauto SA, which borrowed about $15 million in notes due in 2 years, paying rates as high as 17%.

More recently, signs Petro’s agenda may crumble were met with enthusiasm by investors.

Dollar-denominated bonds have rallied since late May, when a scandal involving allegations officials improperly used phone taps and polygraph machines led to resignation of Petro’s chief of staff and a campaign finance probe. Since then, discussions in congress about key reforms have been either pushed to a later date or failed to gain necessary support to advance.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

The Colombian peso has gained more than 15% against the US dollar this year, making it one of the best performing currencies in the world. It continued gains Thursday, hitting its strongest level in nearly a year.

Read more: How Colombia’s First Leftist Presidency Was Derailed: QuickTake

The respite hasn’t flowed to the local bond market. Many companies are postponing plans to sell debt amid the debacle and as inflation proves sticky. Colombia’s central bank, in two years, lifted interest rates to the highest level in nearly a quarter of a century. Inflation is still running above 12%, even as it cools in other Latin American countries.

The government recognizes that the local market has been “withering” and is working with the stock exchange on measures to stimulate liquidity, Public Credit Director José Roberto Acosta said in an interview from New York.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

Pension Overhaul

Petro’s proposal for the pension system seeks to push more worker contributions to the public retirement system, effectively cutting flows to the private funds that hold around a quarter of the 75 trillion pesos ($18 billion) of outstanding corporate debt. The public system does not invest in the securities.

Arnoldo Casas, a money manager at Credicorp Capital, which holds peso-denominated corporate bonds, said the market will get a boost when interest rates start to come down. But for now, the market is lacking liquidity as private pension funds and insurance companies are the main buyers. “The complicated issue is the uncertainty around the pension reform,” he said.

Meanwhile, other parts of Petro’s reform agenda, such as plans to ban new oil drilling, have a direct impact on the economy. The finance ministry estimates gross domestic product will expand 1.8% this year, from 7.3% in 2022.

“The political issue has impacted the market in two ways: first, the energy transition, as the economy’s performance depends on it,” said Juan David Ballén, a strategist at brokerage Casa de Bolsa in Bogota. “And secondly, the pension reform, because pension funds are one of the main investors in capital markets.”

(Updates with currency move on paragraph 12)

Article content

Share this article in your social network

[ad_2]

link originale

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation